Eligibility and Requirements

How do I know if I am eligible for CC4A?

View Eligibility for the eligibility requirements.

Which documents do I need to provide to complete my application?

View Apply to see

the necessary documents.

I am on a fixed income (such as SSA, VA, Pension). Can I still apply?

Yes. If you are on a fixed income and file taxes, please obtain a

Tax Return Transcript. If you did not file taxes, you must submit a notarized Household Income Affidavit and IRS Letter of Non-filing. The Household Income Affidavit will be available for download through your application portal. You can access Tax Return Transcript or Letter of Non-filing

here.

Can I submit more than one application?

No. Applicants may only apply for the CC4A program once. Additionally, only one application may be submitted per household. A household may include a spouse and/or dependents.

If I have participated in Clean Vehicle Assistance Program, Rebate Now, Tune In Tune Up or Replace Your Ride, can I apply for CC4A?

No, you are not eligible for CC4A program if you have received assistance from these programs.

Do I need to have owned the car for two years to be eligible for the program?

You will qualify for the program as long as the vehicle has been owned and operated in California for the past two years. If you have not owned the vehicle for two years or more, you can visit the

DMV website to obtain a Vehicle History Report (VHR). If you have one gap or multiple gaps totaling more than 120 days in your registration history, you must provide Proof of Operability. This Vehicle History Report will show how long the vehicle has been registered in California. If the VHR does not show your current address, please provide a current registration slip on top of your VHR so that program evaluators can see that it’s now registered under your name and within Sacramento County.

I have multiple cars. Can I apply for multiple cars?

Only one car is allowed per household, based upon how the household is listed on your income documents.

If someone lives in your home with an independent income source, then they can apply separately. They must file a separate tax return and cannot be claimed as a dependent.

Can I get a replacement truck or minivan?

You can only get a replacement truck or minivan if you are turning in a truck or minivan.

Does my name have to be on the vehicle registration?

Yes, both the registration and the certificate of title of the vehicle you wish to replace must be in the applicant’s name.

My car title is salvaged. Can I still apply?

If the car is salvaged, the vehicle registration must be current to be eligible to apply.

What happens if I have gaps in my registration?

If you have one gap or multiple gaps totaling more than 120 days in your registration history, you must provide Proof of Operability.

The following documents are acceptable for Proof of Operability:

- Insurance documentation; with the vehicle VIN and effective dates without lapses in coverage totaling more than 120 days.

- Two invoices from an Automotive Repair Dealer registered with the Bureau of Automotive Repair. Invoices must be from two different calendar years, and the oldest may not be older than 24 months. Invoices must include the following:

- Automotive Repair Dealer’s valid registration number

- Name and address of the Automotive Repair dealer

- Description of a repair or maintenance operation performed on the vehicle

- Vehicle year, make, model, and vehicle identification or license plate number matching the vehicle to be retired

- Date of the repair or maintenance visit

My car is on Planned Non-Operation. Can I still apply?

Yes, but the car cannot be on Planned Non-Operation (PNO) for more than 120 days. If it was on PNO for more than 120 days, please provide Proof of Operability (24 months of past insurance or two years of vehicle maintenance records as proof that you have been operating the vehicle). Car registration fees must be paid and current.

I just purchased a new electric vehicle (EV). Can I still apply?

No. You must apply for CC4A first and receive an award letter before purchasing a vehicle to be eligible for this grant incentive.

Can the Vehicle Title and Registration be under two names?

Yes, but please fill out the application using only one name. All documentation must match the name of the applicant. If you have more than one person on the Vehicle Title, talk with your Case Manager to see if both owners must be present when the vehicle is scrapped at Pick N Pull.

How do I count the number of people in my household?

Please reference your taxable household size on your federal Tax Return Transcript. Include spouse, domestic partner, or dependents.

How do I estimate household income?

Please reference the Adjusted Gross Income (AGI) on your federal Tax Return Transcript. When you fill out an application, you will need to provide the prior year’s federal Tax Return Transcript or a Letter of Non-filing from the IRS. The funding we can offer varies based on your household's annual income.

Vehicle Choice and Finance

How much funding can I receive towards the purchase of a clean vehicle?

Grants for clean vehicles range from $7,000-$12,000. The award amount will be dependent upon your household income and mobility option. See

Eligibility for income requirements and

Mobility Options for how much grant you can receive.

How do grants work? Do I need to repay CC4A grant in the future?

Grants are not taxed and do not need to be repaid. You must comply with program requirements and get an approval for grant. The award letter that confirms your grant is presented to the dealer to lower the overall cost of the vehicle you select.

Can I sell or transfer my replacement vehicle?

Participants are allowed to sell or trade-in their vehicles especially when upgrading to a new cleaner replacement.

What kind of vehicle can I purchase with a CC4A grant?

Eligible replacement vehicles are plug-in hybrid (PHEV), battery electric (BEV), fuel cell electric (FCEV), or electric bike. You can purchase new or used vehicles; however, leased vehicles must be new. Leased vehicles must be listed on the New Vehicle Eligibility List for Purchase Incentive Programs list. Used vehicles must be 8 years old or newer and have less than 75,000 miles. All replacement vehicles must be purchased or leased through participating dealerships. See participating dealerships here.

What’s the price range for EVs? How much will it cost to participate?

The price range of a clean vehicle varies depending on whether you are purchasing or leasing a new or used vehicle and the vehicle's condition. It is likely that your grant amount will not cover the entire cost of the vehicle. However, the price of the vehicle must not exceed $46,000.

Can I use the CC4A grant to purchase a used vehicle?

Yes, you can use the grant towards the purchase of a new or used vehicle. If purchasing a used vehicle, it cannot be more than 8 years old, have more than 75,000 miles, or have open recalls.

Can I use my CC4A grant at any auto dealership?

No. Our grants can only be used at

participating dealerships and e-bike retailers. We have contracted dealerships to ensure customers are treated fairly and consumer protections are observed.

Can I get funding for a home EV charger through this program?

If you purchase a new or used plug-in hybrid (PHEV) or battery electric vehicles (BEV), you may be eligible for up to $2,000 in charging support for EVSE or EVgo charging credit. See Charging and Charging Stations in Resources for more information.

Does this program offer financing?

No, this program does not include financing. You may seek financing through credit unions, banks, or through the dealership. The program requires that loans have an interest rate lower than 16%.

Application Process

How do I apply for this program?

You can apply for CC4A online. Start your application

here. As part of the application, you will need to submit documents to demonstrate eligibility for the CC4A program.

What if I don’t have a computer or need help applying?

Case managers are available to assist anyone who would like additional help in applying for CC4A. You may contact us

at

855-201-5626 or cc4a@energycenter.org. Paper applications are also available upon request.

What if I don’t speak English?

The case management team provides support in English and Spanish. Additional language assistance is provided using over the phone translation services. When you call into the call center, be prepared to tell the case manager which language you need translation services for. We also recommend using the assistance of a family member, friend, or trusted individual who can work with a case manager on your behalf.

What if I don’t want to replace my old vehicle with another car?

Participants may choose the e-bike option if they do not want to get a replacement vehicle. See Mobility Options for more information.

How long does the program take?

Timelines are dependent upon the program caseload. Currently, we anticipate the process to take about 120 days. We ask for your patience throughout the process. Please ensure you have all the required documents when you submit your application. See the required documents here. Submitting incorrect documentation can lead to additional delays in processing your application. Reach out to a case manager if you require assistance getting the appropriate documents together. We will review applications in the order they are submitted.

How do I check the status of my application?

You can view your application status by logging into your

Fluxx account that you created to start your application. When you log in, you will be able to view your profile and navigate to check your application status. Your status will change from "Submitted" to "Under Review" as soon as a case manager begins to review your application, and a case manager will reach out to you with next steps or questions.

When do I bring my car to be retired (post-inspection)?

You cannot bring your car to be retired until you have purchased your replacement car. There are no exceptions. After you purchase your replacement car, you will be notified when your grant has been reimbursed to the dealership where you purchased or leased your vehicle. Within 14 after this notification, you must take your vehicle to be retired back to the authorized dismantler for a post-Inspection and to scrap your vehicle. Please bring your completed pre-inspection checklist, your post-inspection checklist, vehicle title, and driver’s license. It is suggested that you call ahead of time to get a sense of wait times.

Can I take my older vehicle to any dismantler to be scrapped/retired?

No. Your vehicle must be brought to an authorized CC4A dismantler. Pick-N-Pull is the only authorized dismantler participating in the Sacramento Program. Please review your pre and post-inspection paperwork for a list of authorized locations.

Do I have to be willing to relinquish my older vehicle to be scrapped/retired?

Yes, you must be willing to relinquish your older vehicle to the dismantler within 14 days of receiving your post-inspection and scrapping notification

How do I receive my CC4A grant?

An award letter is granted after your application has been approved. The value of the award letter is paid directly to the dealership on behalf of the grantee. You will need to bring your award letter to an authorized dealership, and the dealer will verify your award and add the grant amount as a down payment on the sales contract.

When does my award letter expire?

Participants are encouraged to purchase their replacement vehicle within 60 days. If you need more time, please reach out to your Case Manager.

How do I use the Fluxx online granting system?

Follow instructions below to complete an online application. If you need a paper application, please email our case management team at cc4a@energycenter.org.

- To be considered for funding, you must complete an online application.

- To begin your online application, start by creating a user account for the Fluxx portal. To create a user account and access the online application please visit the

CC4A Fluxx portal.

- Please click on the "Create an Account Now" to start, and ensure you have entered accurate information (including email address) when completing the registration form.

- You will then receive an email notification from Sacramento Metropolitan Air Quality Management District with login information, which will give you access to the portal and application.

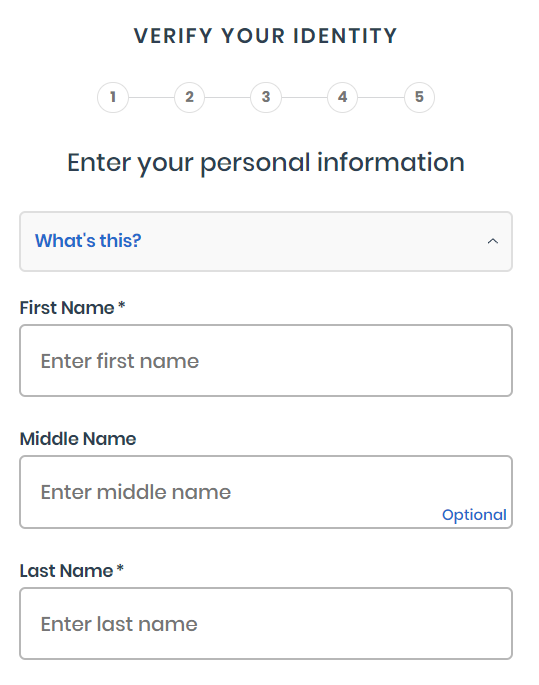

- Enter your personal information and click “submit request”.

- After you submit your request, you will receive a confirmation email asking you to verify your account and create your password. Check your spam folder, as the email may end up there.

- Create a password and click “set password and login”. You will be immediately granted access to the system.

- Once you register you can complete the application by clicking the green text box, “Apply for Clean Cars 4 All Grant”

- If you require additional assistance creating your account, please contact your Clean Cars 4 All Case Manager.

Tips for filling out the application form

Document Collection

Which year do you need my income information for?

You must submit income information for 2024.

How do I know if I need a Tax Return Transcript or a Letter of Non-filing?

If you filed taxes, provide your 2024 Tax Return Transcript. If you did not file tax, please provide your 2024 Letter of Non-filing and Household Income Affidavit.

How do I get a Tax Return Transcript from the IRS?

You may request your information from the IRS through any one of the following options.

Tip: To avoid delaying the time it takes to access your tax records from the IRS, we highly recommend that you first try to do the Online Instant Download (Option 1).

- IRS Option 1 - Online instant download

- IRS Option 2 - Online request by mail

- IRS Option 3 - Request by mail or fax

- IRS Option 4 -

Schedule an appointment at the IRS office

-

IRS Option 5 - Call to Request by Mail

How do I get a Letter of Non-filing from the IRS?

You may request your information from the IRS through any one of the following options.

Tip: To avoid delaying the time it takes to access your tax records from the IRS, we highly recommend that you first try to do the Online Instant Download (Option 1).

- IRS Option 1 - Online instant download

- IRS Option 2 - Online request by mail

- IRS Option 3 - Request by mail or fax

- IRS Option 4 - Schedule an appointment at the IRS office

- IRS Option 5 - Call to Request by Mail

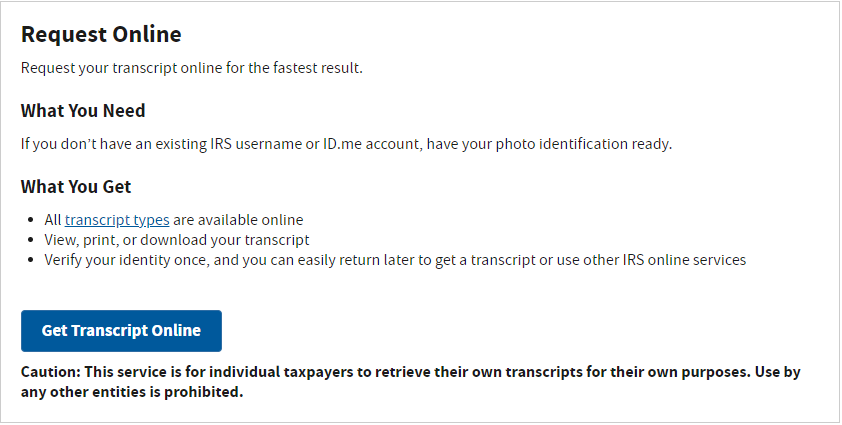

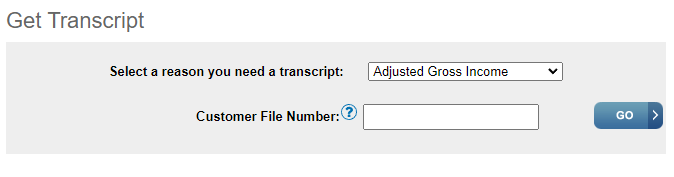

IRS Option 1: Online Instant Download

Tip: When going to the IRS website to request your transcript, use the Internet Explorer browser to allow for instant document downloads. We also recommend submitting the request on a computer rather than on a smartphone device. Requests made on a smartphone may be rejected by the IRS.

- Go to the IRS page

here.

- Click on "Get Transcript Online".

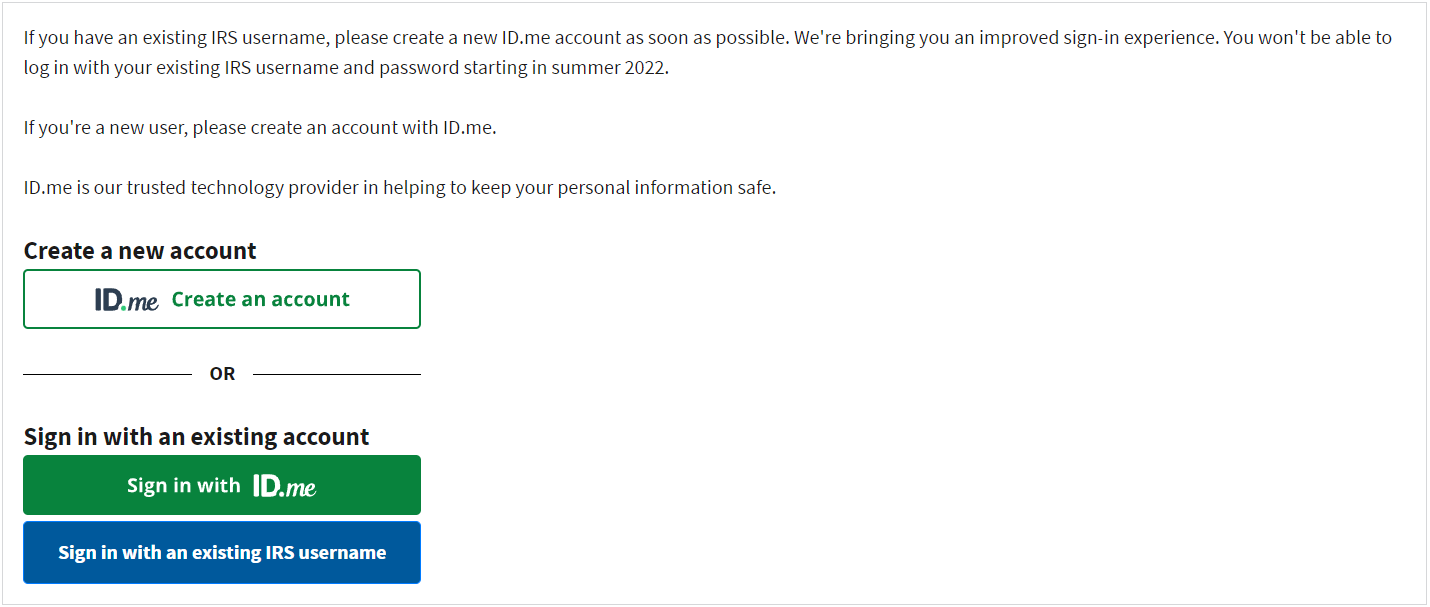

- Click on "ID.me Create an account" if you don't have an account. Click on "Sign in with ID.me" if you have an existing account and proceed to Step 12. Please note, using ID.me requires access to your email and cell phone to receive confirmation texts.

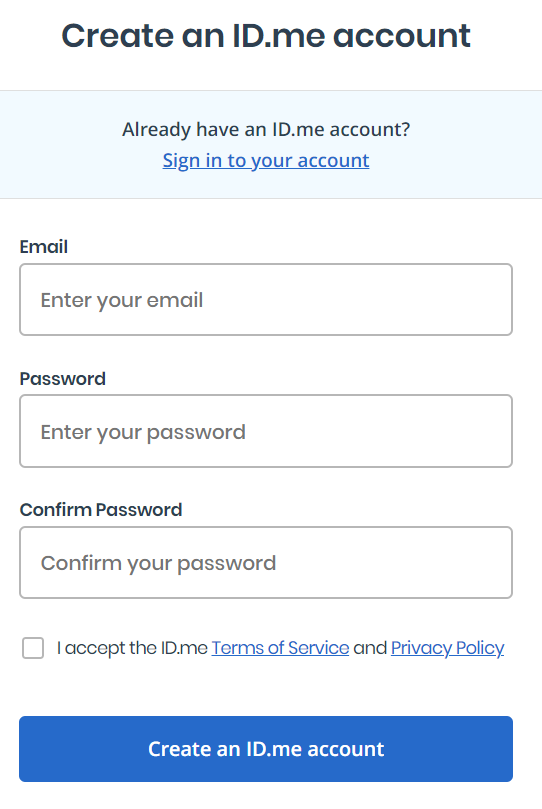

- Fill out your email and password.

- Go to your email and confirm your email address.

- Enter your information and click "Continue."

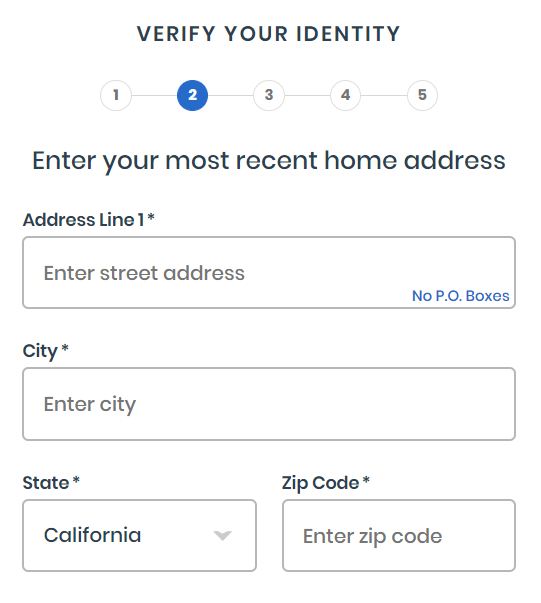

- Enter your most recent home address and click "Continue."

- Provide a form of identification, your driver's license, passport, or other.

-

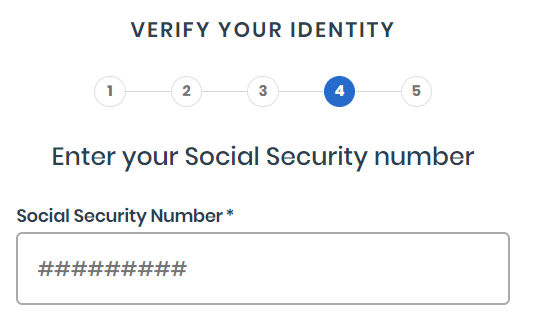

Enter your Social Security number and click "Continue."

-

Verify

that your information is correct and click "Continue."

-

Once

your ID.me is verified, sign in

here.

-

Select "Adjusted gross income" for reason.

-

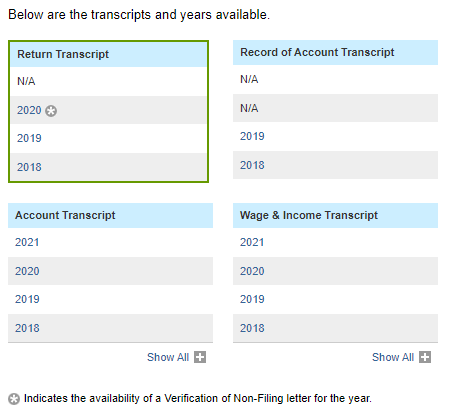

If you filed tax in 2024, select 2024 under Return Transcript. If you did not file tax, select the document with * that indicates Verification of Non-filing Letter.

- Save or print the document to upload to Fluxx.

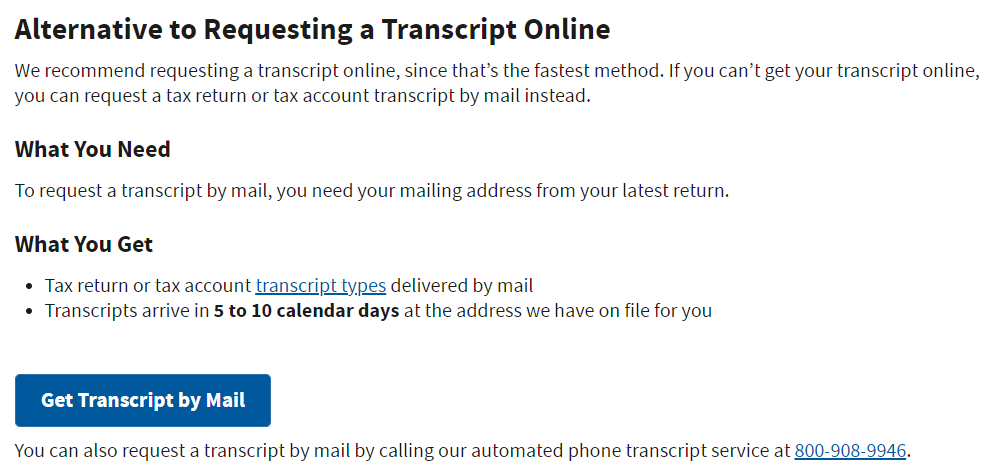

IRS Option 2: Online Mail Request

- Go to IRS page

here.

- Click "Get Transcript by Mail."

- Click "OK" to proceed.

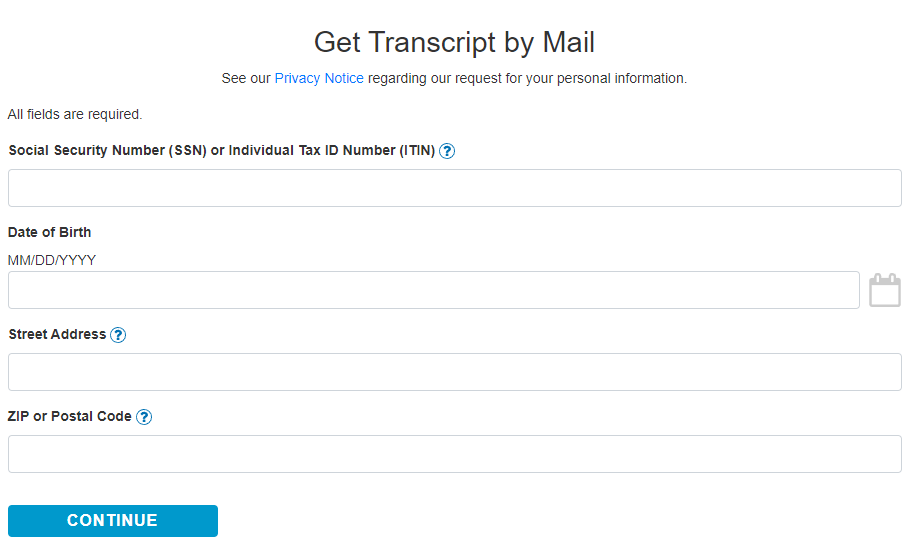

- Fill out your information. The street address must match the address you put when you filed tax for that year. Click "Continue." Tip: When entering your address, use abbreviations, (Ave, St, Ct, Blvd). The website is very sensitive about how addresses are input. If the request does not go through, try again and type in your address in a different way.

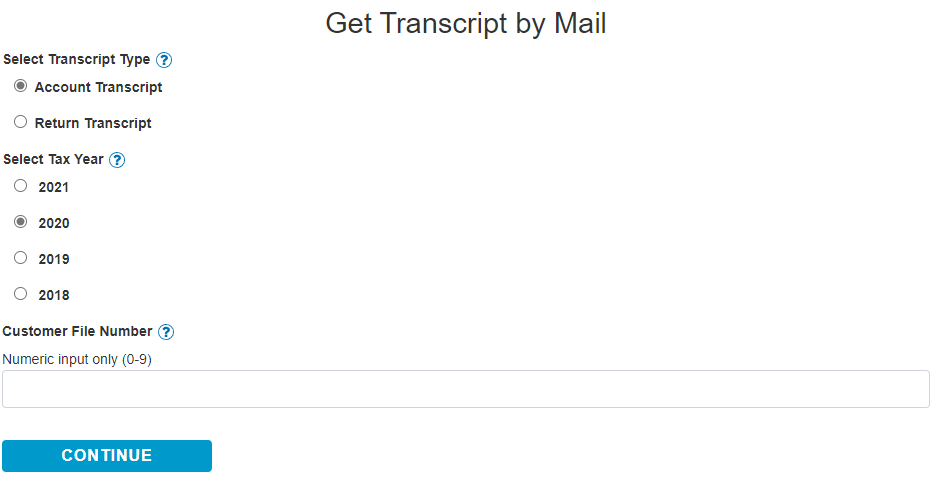

- Select "Return Transcript" for Transcript Type. Select "2024" for Tax Year. Then, click "Continue."

- If successful, you will see the following confirmation page.

IRS Option 3: Request by Mail or Fax

To submit request via mail, fill out the Form 4506-T available

here. If you do not have a printer, request Case Manager to mail you a copy of the form. Complete forms must be mailed or faxed to the IRS at the following address:

By Mail:

Internal Revenue Service

RAIVS Team

P.O. Box 9941

Mail Stop 6734

Ogden, UT 84409 |

By Fax:

(855) 298-1145 |

IRS Option 4: Schedule an Appointment at the IRS Office

In the case, IRS is unable to verify your identity or your past records. In this case it may be necessary to schedule an in-person appointment at your local IRS Office. Find the nearest IRS office

here. Schedule appointments by calling (844) 545-5640.

Sacramento IRS Office

4330 Watt Ave

Sacramento, CA 95821

Phone: (916) 974-5225

For any additional assistance requesting your tax information, please reach out directly to the IRS at (800) 829-1040.

IRS Option 5: Call to Request by Mail

*Over the phone assistance may be limited due to the COVID-19 Health Crisis.

The IRS has an automated telephone self-service that can be used to order a Tax Return Transcript. Call (800) 908-9946 to make the request.

Note: You will not be able to request your Letter of non-filing using this phone service.

Where can I find a Notary for the Household Income Affidavit Form?

Applicants who do not file taxes, must submit a Household Income Affidavit. To complete the Household Income Affidavit, you must use the notary service to verify your information. Please make sure you bring an identification card with you. Here are locations to help access a notary:

- Most United Parcel Service (UPS) locations offer notary services. We recommend calling in advance to check notary services are available and whether you can walk in or need an appointment. Find the nearest UPS store

here. Notary service is estimated to cost $15.

- Banks and credit unions offer notary services for free or for a small charge. We recommend calling your local branch to see if they are open and have notary service available.

- American Automobile Association (AAA) members have access to free notary services. Call your local branch to see if they can offer this service for you.

- Mobile notaries are available but come at an additional cost. A mobile notary will typically charge for their service in addition to their travel costs.

How do I get in contact with the DMV during the COVID-19 health crisis?

Online

DMV provides services online. Check the DMV website for a complete list of online services available

here. Please note that you must create an online account with DMV to access these services.

Kiosks

Self-service kiosks are available at select locations. Check the locations and what services they offer

here.

Field Office

Field offices are open and available. Visit the DMV website for latest information on field offices

here.

Phone

To contact a DMV agent by phone, call (800) 777-0133. Once you are on the line, you will hear a message regarding DMV’s status due to COVID-19, then directed to an automated speaker to select a reason why you called. Say "Vehicle" or "Vessels" or select 1. Then, say "speak to a representative", to get a call back from a DMV agent.

Tip: The DMV will not give an option to speak to a representative, so you must say “speak to a representative”. You have the choice of waiting for the agent on the line, or you can request a call back by pressing 1.

Mail

Several services are still available by mail. To complete requests, download the appropriate form from the DMV website. Follow the directions on the form and submit via mail. Access form for vehicle registration

here. Access form for change of address

here. Reach out to your Case Manager if you need assistance.

Alternative Option

If you are a member of AAA, you may be able to access some DMV services at your local AAA office branch. Find your local branch

here.

How do I get my vehicle's Registration History from the DMV?

As part of your application, you will need to provide proof of the vehicle's registration for the last 2 consecutive years. If your vehicle has not been registered, alternative documentations are required. Talk to your Case Manager for more information. You can access your vehicle's registration here. You may download and print for $2.

Please have the following information ready when making the request:

- Driver's License #

- Last 5 digits of your vehicle's VIN #

- License plate #

- Credit or debit card information

Others

Where can I charge an Electric Vehicle?

See Charging and Charging Stations in

Resources for public charging stations. If you purchased or leased a PHEV or BEV, you may get additional funding for EVSE or EVgo charging credit.

Can I stack a CC4A grant with other clean vehicle incentives/rebates?

A CC4A grant cannot be stacked with Clean Vehicle Assistance Program, Rebate Now, Tune in Tune-Up, and Replace your Ride. Programs you can stack with CC4A include Clean Vehicle Federal Tax Credit. See Other Clean Car Grants and Rebates in

Resources for more information.

How long will the CC4A Program be available?

The CC4A program is accepting applications until available funds are exhausted. Applications are processed on a first-come, first-served basis. Applicants are encouraged to apply as soon as possible. Submitting an application does not guarantee that you will receive an award letter.

How many participants in Sacramento County have been awarded CC4A grant?

As of June 2024, CC4A has awarded over $10 million to 1,290 awardees, reducing emissions and improving public health in our region. See a map of the neighborhoods where old polluting vehicles have been replaced with zero or near-zero emissions vehicles

here.

Who can I contact if I have questions about the CC4A Program?

Case managers are available to answer any of your questions and assist applicants throughout the process. The call center is open Monday through Friday from 9:00 am- 5:00 pm PST. Case managers are available to answer inquiries in English and Spanish. If you require ADA accommodations or other language translation services, please let us know to best assist you. See Application Resource Guide in

Resources if you need help accessing documents from IRS or DMV.